stock market bubble meaning

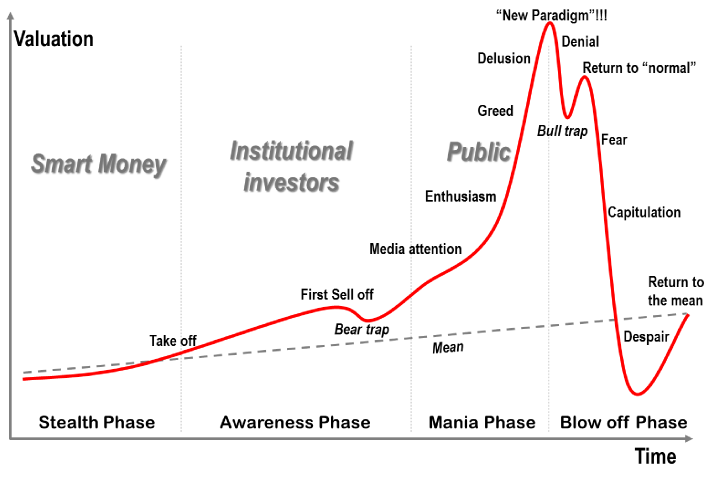

A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a period of time well in excess of its intrinsic value.

Stock Market Bubble What Does It Mean

If you put your money in the market you want to get back more than you put in.

. The story began easily enough if not with once upon a time A virus forced the country to shut. Our Mastering the Psychology of the Stock Market series concludes as we take a closer look at investing bubbles. STOCK MARKET BUBBLE meaning - STOCK MARKET BUBBLE definition - STOCK MARKET BUBBLE explanati.

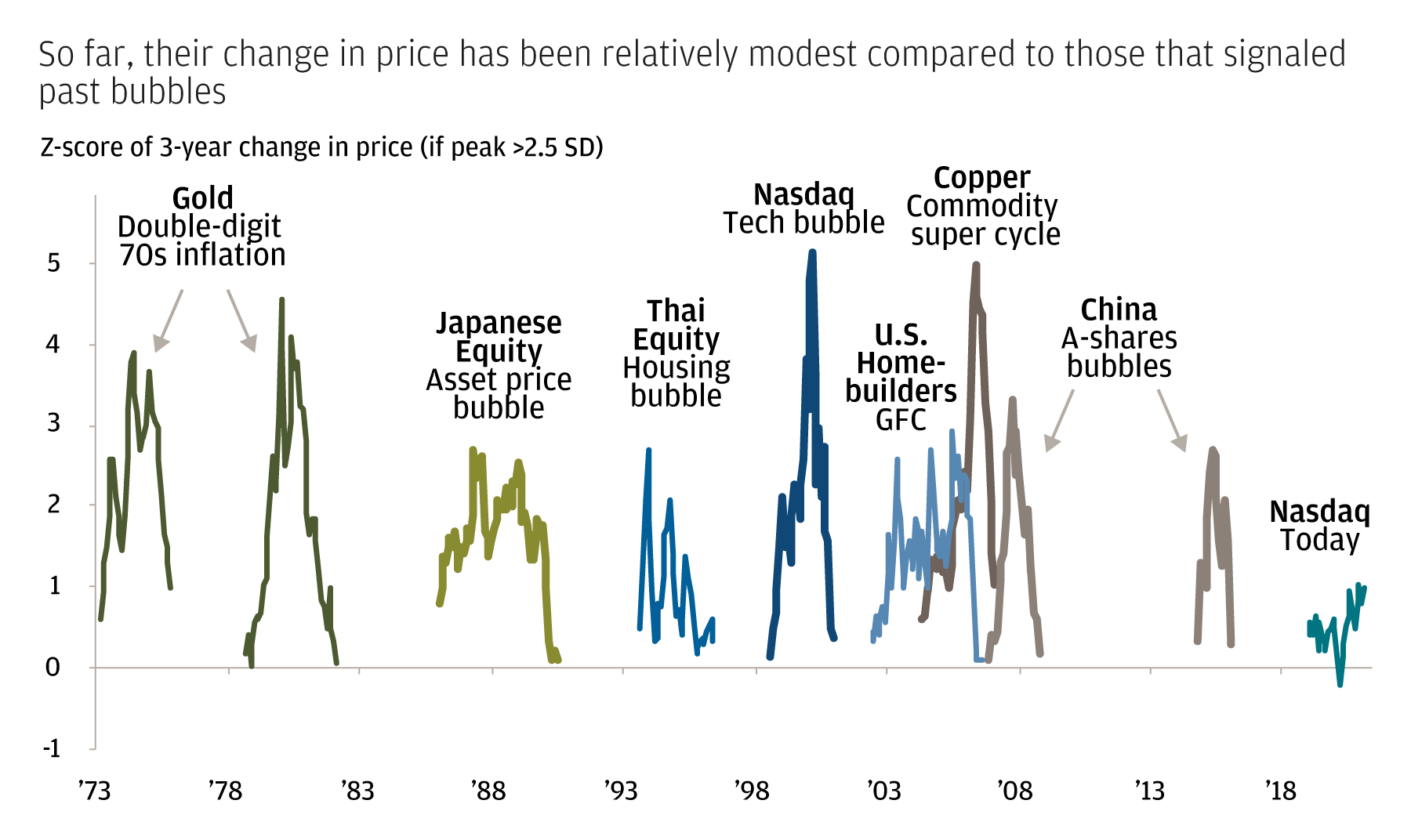

The stock market bubble of the 1920s the dot-com bubble of the 1990s and the real estate bubble of the 2000s were asset bubbles followed by sharp economic downturns. What does STOCK MARKET BUBBLE mean. The term bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or.

This occurs when there is demand for a particular asset resulting in a price surge that is often. Grantham added that as bubbles form they give us a ludicrously overstated view of our real wealth. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

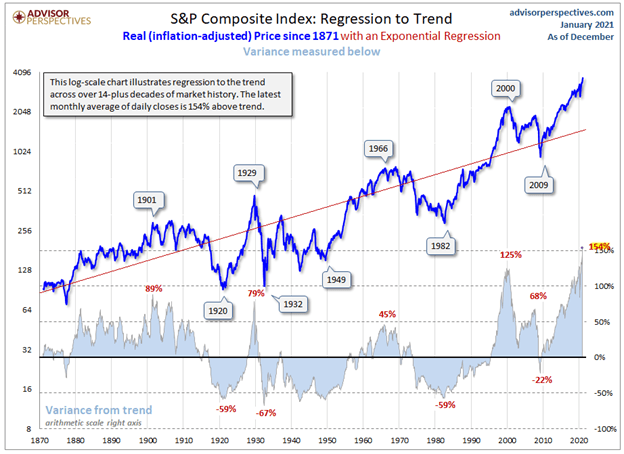

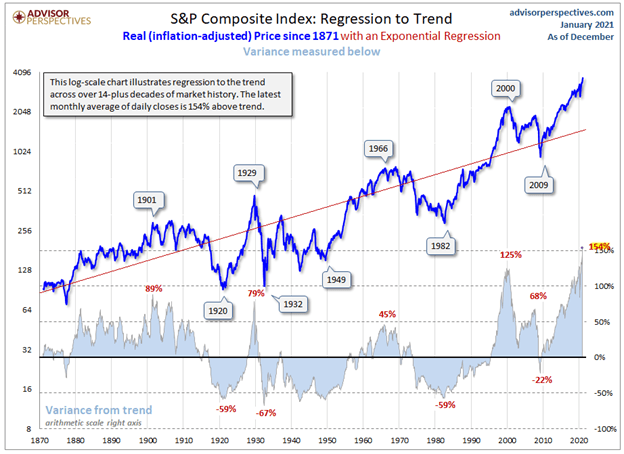

That makes a trade feel worth the risk for me. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place. He told Insider the SP 500 and Nasdaq look overvalued by any traditional metric as bubble fears increase.

What is STOCK MARKET BUBBLE. Stock market bubbles typically occur when investors overvalue equities either because theyve engaged in excessive speculation relied on bad information or misjudged valuations. Is the US facing a stock market super-bubble.

In economic terms a stock market bubble is occurring when stock prices have increased significantly without any corresponding increases in the. Part 4 - Mastering the Psychology of the Stock Market Series. The steep ascent is almost always followed by a sudden plunge.

A stock market bubble happens when a stock costs a lot more than its worth or the market in general is overvalued. Just because youre a perma-bear doesnt mean youre a visionary and if youre only right once every couple of. A bubble occurs when an assets price increases in a short period to unprecedented levels.

A financial bubble is. Jeremy Grantham co-founder of hedge fund GMO is warning that stocks could fall a lot further. How to Know When a Stock Market Bubble is about to Pop.

A stock market bubble is a period of growth in stock prices followed by a fall. Let the wild rumpus start. Once a bubble bursts a stock market crash often follows.

A stock market bubble is a period of growth in stock prices followed by a fall. Every stock market bubble begins with a story and make no mistakethis is a stock market bubble. Jonathan Boyar has been a value investor for 15 years and called the 2008 market crash.

Where have you heard about a stock market bubble. When they fall they do so quickly and often below the starting value. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

After Jeremy Granthams warning analysts fear more volatility ahead. The dotcom bubble also known as the Internet bubble grew out of a combination of the presence of speculative or fad-based investing the abundance of venture capital funding for startups and the. 2 days agoThe old saying goes you never know youre in a bubble until it bursts and that is especially true in the stock market.

Is approaching the end of a superbubble spanning across stocks bonds real estate and commodities following massive stimulus during the COVID pandemic potentially leading to the. A stock market bubble is when share prices climb too far beyond fundamental values. In my trades I aim to get back three times as much money as I can accept losing.

Is The Us Stock Market In A Bubble That S About To Burst J P Morgan Private Bank

Is The Fed Fueling A Giant Stock Market Bubble

Are We In A Stock Market Bubble Right Now Stopsaving Com

What Is A Stock Market Bubble Forbes Advisor

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Stock Market Crash Ahead The 2020 Fed Bubble Youtube

See How To Identify And Trade Stock Market Bubbles

Investors Can T Ignore This Clear Sign Of A Stock Market Bubble Seeking Alpha

/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)