snohomish property tax payment

Snohomish WA 98291-1589 Utility Payments PO. It could have been better.

Snohomish County Treasurer Payments

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

. Regional Transit Authority RTA No. What is the property tax rate in Snohomish County. For Washington State DOR filing information select the DOR Filing Instructions menu item.

Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706. We are now accepting credit card payments in-house along with online. You will need a current statement from Snohomish County to create an account.

Regional Transit Authority RTA No. Snohomish WA 98291-1589 Utility Payments PO. I have read the above and would like to pay online.

Use the search tool above to locate your property summary or pay your taxes online. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. The Assessor and the Treasurer use the same software to record the value and the taxes due.

Search for Property Taxes. Snohomish WA 98291-1589 Utility Payments PO. Need Property Records For Properties In Snohomish County.

Please include your PUD bill payment slip to avoid any delays in processing your payment. Make check or money order payable to. 425-262-2469 Personal Property.

Property Tax Exemptions Email the Property Tax Exemptions Division 3000 Rockefeller Ave. Help with Online Payments. Using this service you can view and pay them online.

To get help with online payments either email the treasurer with your question or call customer service at 425-388-3366. Use the search to locate and pay your bill with Quickpay instead. MS 510 Everett WA 98201-4046 Ph.

Snohomish County Treasurer 425-388-3366. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

Prefer not to login. If paying after the listed due date additional amounts will be owed and billed. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

Once you have registered for a Paystation account you can instantly access and manage your bills from Snohomish County. Snohomish Boys. Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property.

In this mainly budgetary function county and local public leaders estimate annual spending. Online City Utilty Payments. When summed up the property tax burden all owners shoulder is created.

You must have an existing account before you can sign in with Google. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. Other Places to Pay with Credit Cards.

Additional tax payment options including online payment options are. Pay for services online. PO Box 1100 Everett WA 98206-1100.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. Personal Property Tax Listing Forms are due into the Assessors Office by April 30th. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. How was your experience with papergov. The following links maybe helpful.

Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706. Treasurer Tax Collector Offices near Everett. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined.

Public Transportation Benefit Area PTBA Snohomish PTBA. Check money order cashier check. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier.

Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone. Taxes Snohomish Tax Data. Snohomish County Property Tax Payments Annual Snohomish County Washington.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Median Property Taxes No Mortgage 3534. Online City Utilty Payments.

Find Snohomish County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. Your bill comes with a self-addressed return envelope for your convenience.

Securely make a payment with a credit card debit card or by eCheck. Median Property Taxes Mortgage 3638. Use My Location Everett.

Ad Find Information On Any Snohomish County Property. In case you missed it the link opens in a new tab of your browser. Snohomish Boys.

Free Snohomish County Property Tax Records Search. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. For instructions to electronically file personal property tax listings with the Snohomish County Assessor using this web-site select the Help menu item.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Graduated Real Estate Tax Reet For Snohomish County

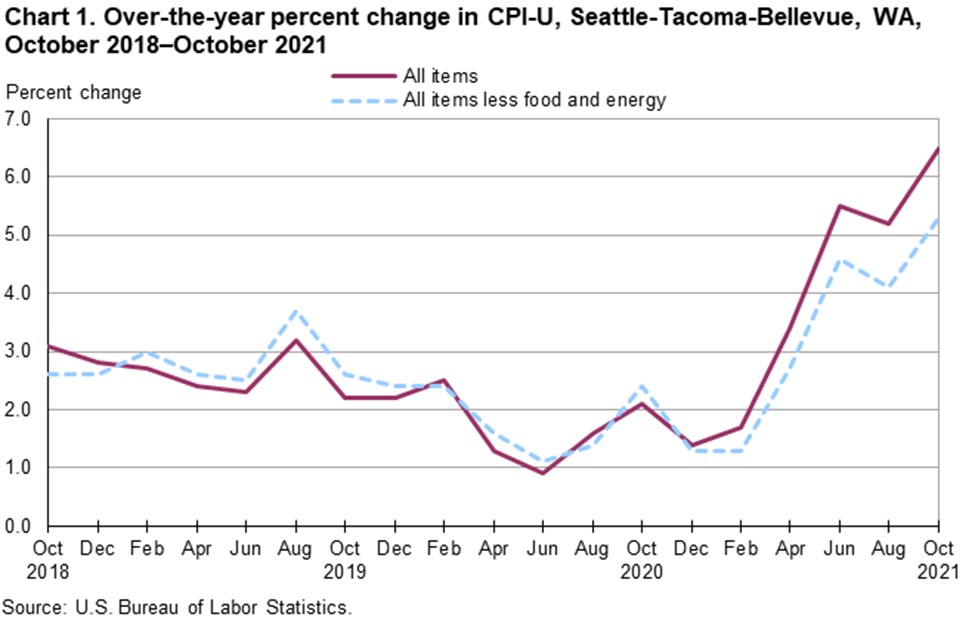

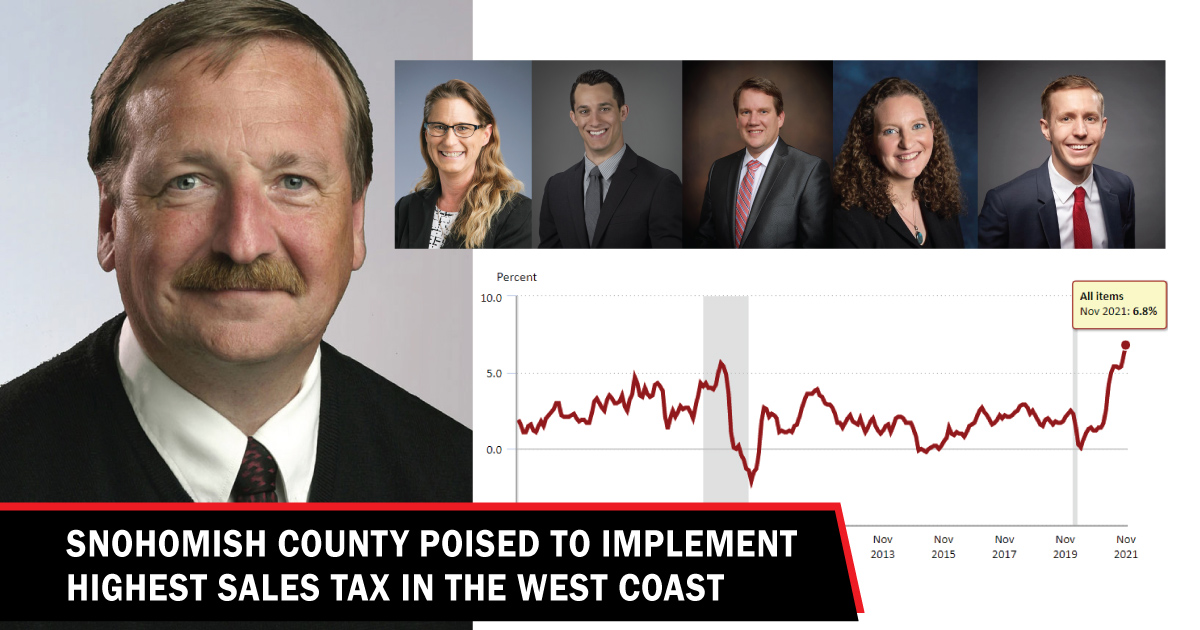

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Snohomish County Camano Association Of Realtors Linkedin

About Efile Snohomish County Wa Official Website

Pin By The Platz Group On Homes For Sale In Snohomish County Marble Tile Floor Corner Fireplace Outdoor Decor

Tax Payment Options Snohomish County Wa Official Website

Property Taxes And Assessments Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Snohomish County Voting Today To Determine The Future Of Property Tax Levies

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Backyard Views Low Maintenance Yard Real Estate Trends

Tax Payment Options Snohomish County Wa Official Website

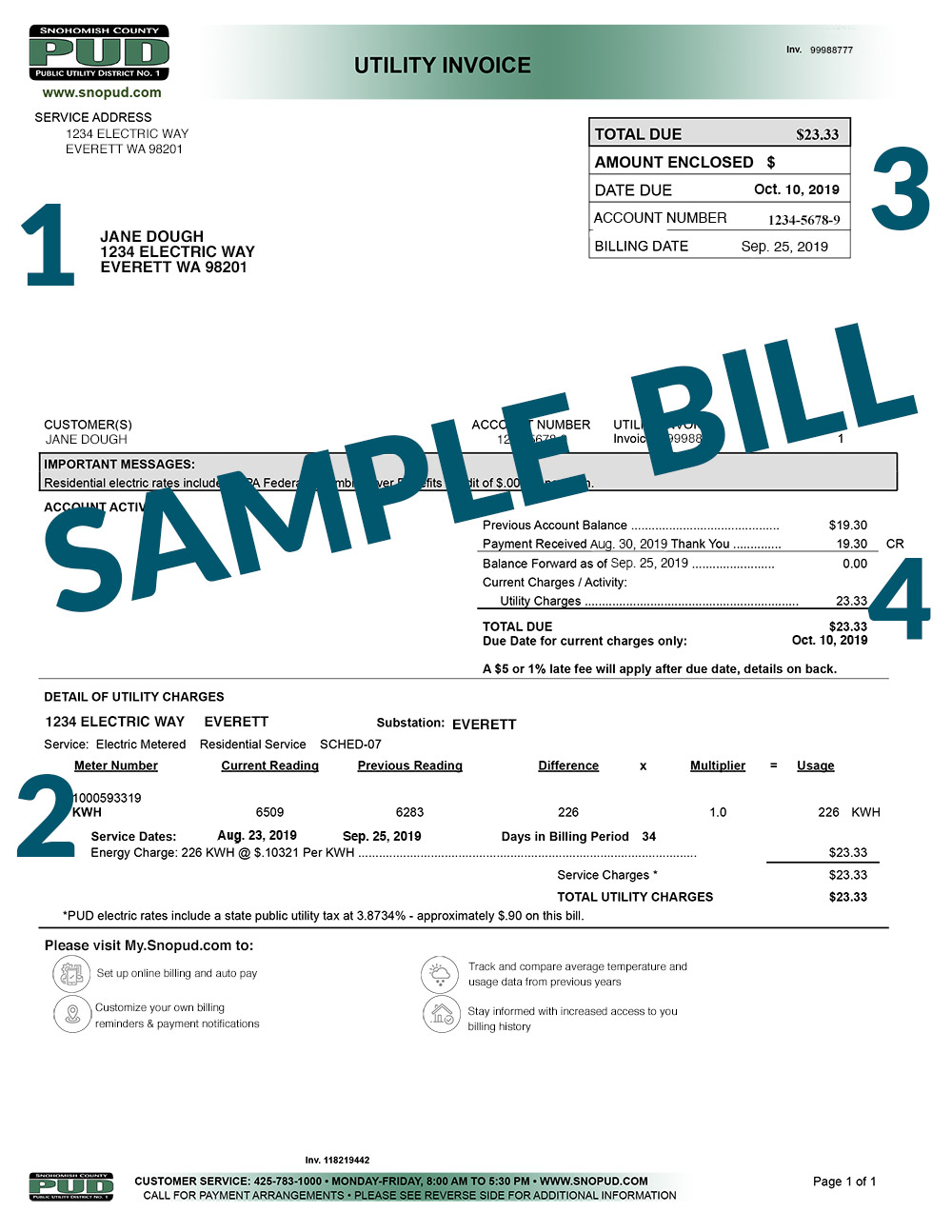

My Billing Statement Snohomish County Pud

Congrats Randi Szakaly On Your New Active Listing In Lynnwood Mls 1071717 Address 626 Logan Road Lynnwood 98036 Http Lynnwood Snohomish County Century